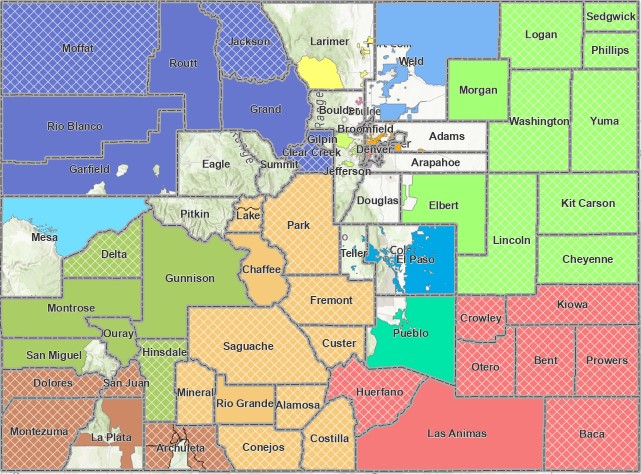

Northwest Enterprise Zone

The Enterprise Zone program was established by the Colorado Office of Economic Development and International Trade (OEDIT) to provide tax credits to businesses that locate to and/or expand in designated economically distressed parts of the state.

AGNC serves as the administrator for the Northwest Enterprise Zone, which includes Clear Creek, Garfield, Gilpin, Grand, Jackson, Moffat, Rio Blanco, and Routt Counties.

Economic distress measures

All enterprise zones need to meet at least one of these economic distress criteria defined by U.S. Census Bureau’s American Community Survey (ACS) data and/or Colorado Department of Local Affairs (DOLA) data. We post eligibility data from the ACS 5-year survey data that is released each December covering the period ending the prior calendar year.

To qualify, areas need to meet these qualifications:

- population growth rate less than 25% of the state average

- unemployment rate greater than 25% of the state average

- per capita income less than 75% of the state average

Enterprise Zone Contribution Tax Credit

- 25% of a cash donation as a state income tax credit

- 12.5% of an in-kind donation as a state income tax credit

The amount of this tax credit is capped at $100,000 per taxpayer per tax year. If you cannot use all of your credits in a given tax year, you can carry forward the balance up to five years.

Business Tax Credits and Incentives

Enterprise Zone Job Training Tax Credit

12% of eligible training costs

Businesses can earn a state income tax credit for 12% of eligible job-training costs for employees working within the enterprise zone. This tax credit helps develop a skilled workforce in distressed communities. Even if the business leaves the community, the skilled workforce typically remains an asset to the local economy.

Enterprise Zone New Employee Tax Credit

$1,100 or more per net new employee

Businesses can earn a state income tax credit of $1,100 per net new employee. Businesses can earn more tax credits if the business is an agricultural processor or is in an enhanced rural enterprise zone. This tax credit encourages businesses to hire and expand employment opportunities, thus reducing unemployment rates. State and local governments benefit from income and sales tax revenue generated from these employees.

Enterprise Zone Employer-Sponsored Health Insurance Tax Credit

$1,000 per net new employee

For the first two years that a business is in an enterprise zone, the business can earn $1,000 per net new employee insured under a qualified health plan for which the employer pays at least 50% of the cost. This tax credit encourages businesses to provide a qualified health insurance plan to employees, potentially improving community health, and reducing public health costs.

Enterprise Zone Research and Development Tax Credit

3% of an increase in research and development expenses

Businesses can earn a 3% tax credit for an increase in annual research and development expenses compared to what they spent the prior two years. Investment in research and experimentation supports an innovative economy. A research and development focused business that sells products, services, or intellectual property will bring outside dollars to the local economy.

Enterprise Zone Vacant Commercial Building Rehabilitation Tax Credit

25% of rehabilitation costs (up to $50,000 in credits on $200,000 or more in costs)

If a business rehabilitates a commercial building that is at least 20 years old and has been vacant for at least two years, the business can earn a state income tax credit for 25% of rehabilitation costs (up to $50,000 in credits on $200,000 or more on costs). This tax credit encourages the revitalization of dilapidated buildings and blighted areas, bringing new businesses and employees to the community. State and local governments gain tax revenue from new economic activity.

Enterprise Zone Commercial Vehicle Investment Tax Credit

1.5% of purchase price

A taxpayer can earn a state income tax credit for 1.5% of the price of new commercial trucks, truck tractors, tractors, semi-trailers, and associated parts registered in Colorado and used in an enterprise zone. This tax credit encourages businesses to register new commercial vehicles in Colorado and pay Colorado licensing and registration fees.

Enterprise Zone Investment Tax Credit

3% of business personal property investment

Businesses can earn a state income tax credit for 3% of an investment in business personal property. New business personal property increases a company’s capacity. The taxes a business pays on these purchases far exceed all tax credits under the enterprise zone program.

Enterprise Zone Sales and Use Tax Exemption for Manufacturing and Mining

Sales and use tax exemption

The statewide sales and use tax exemption for purchases of manufacturing equipment is expanded to include non-capitalized equipment and parts if the business is located within a zone. The enterprise zone statutes also expand manufacturing to include mining.

For more information on the Enterprise Zone program including how to apply for those credits and to check if your business is located within one of the designated areas, please visit the Colorado State website: www.choosecolorado.com/ez.

For questions about the Northwest Enterprise Zone, please contact us either by e-mail at admin@agnc.org or call (970) 665-1095.